Solo Lending (also known as SoLo Funds) has become a popular app for individuals looking to borrow small-dollar, short-term loans directly from other users. Known for its community-driven, peer-to-peer lending model, it allows borrowers to request funds with flexible repayment terms, while lenders earn tips or donations in return.

But what if you’re looking for apps similar to Solo Lending?

Whether it’s because of loan limits, availability, approval process, or platform preference, you might want to explore other P2P lending platforms or emergency loan alternatives. This article covers the top apps and platforms like Solo Lending, along with key features, pros, cons, and how they compare.

What Is Solo Lending?

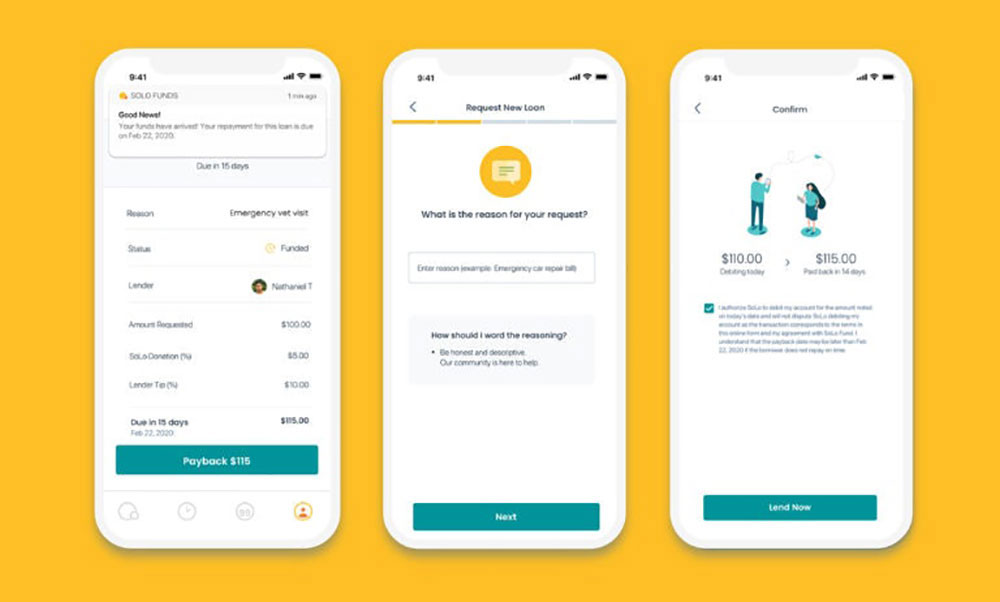

Solo Lending, or SoLo Funds, is a peer-to-peer lending app that connects borrowers with individual lenders. Instead of using a traditional bank or payday loan company, users borrow directly from each other. There’s no interest by default, but borrowers can offer a tip as a voluntary incentive.

Key Features:

- Borrow up to $57

- No interest (only optional tips)

- Fast funding (within minutes)

- No minimum credit score required

- Community-based trust scoring

Why Look for Alternatives to Solo Lending?

Users may seek alternatives due to:

- Limited loan amounts

- Tip-based repayment model

- Availability (not all states supported)

- Preference for structured terms

- Need for higher loan limits or longer terms

Top Apps Similar to Solo Lending

Earnin

- Best for: Employees needing early access to wages

- Key Features:

Access up to $100–$750 from upcoming paycheck

No mandatory fees or interest

Optional tips, similar to SoLo

- Pros: Instant cashouts, no credit check

- Cons: Must link to a qualifying bank and direct deposit

Dave

- Best for: Cash advances and overdraft protection

- Key Features:

Up to $500 advance without interest

Budgeting and side hustle features

- Pros: Straightforward app, bank integration

- Cons: $1 monthly membership fee

Brigit

- Best for: Budgeting and emergency cash

- Key Features:

$50–$250 in instant cash advances

Credit protection & financial tracking

- Pros: No interest, smart budgeting tools

- Cons: $9.99/month subscription required for full features

Cash App Borrow

- Best for: Cash App users needing small loans

- Key Features:

Short-term loans up to $200

Direct repayment from Cash App account

- Pros: Easy for Cash App users

- Cons: Not available to all users; fees apply

Kiva

- Best for: Microloans for business or community projects

- Key Features:

Zero-interest loans up to $15,000

Crowdfunded by individual lenders

- Pros: Supports entrepreneurs and small businesses

- Cons: Application process is longer

LendingClub

- Best for: Larger personal loans with fixed terms

- Key Features:

Loans from $1,000–$40,000

Fixed interest rates

Requires credit check

- Pros: Professional lending structure

- Cons: Not peer-to-peer in the traditional sense anymore

Comparison Table: SoLo vs. Similar Platforms

PlatformLoan RangeCredit CheckInterest/TipP2P-Based?AvailabilitySoLo Funds$20–$575NoOptional tipYesLimited statesEarnin$100–$750NoOptional tipNoNationwideDaveUp to $500NoNo interestNoUS-basedBrigitUp to $250NoNo interestNoMost statesKivaUp to $15,000NoNo interestYesGlobalLendingClub$1,000–$40,000YesFixed interestNoUSHow Peer-to-Peer Lending Platforms Work

Peer-to-peer (P2P) lending apps like Solo Lending and Kiva connect individual borrowers and lenders through a digital platform. Instead of borrowing from a bank:

- Borrowers post a loan request

- Lenders fund the loan partially or fully

- Terms and repayment timelines are agreed upon in advance

- Some platforms charge a fee, while others work on voluntary tips

This decentralized model creates more accessible financing options, especially for those with limited credit history.

Pros of Using Apps Similar to Solo Lending

- No or low-interest borrowing

- Alternative to payday loans

- Fast approval and funding

- Credit score not always required

- Community-based lending with social impact

Cons and Risks

- Tips or fees can add up over time

- Limited loan amounts for some platforms

- Not regulated like banks

- Availability varies by state

- Risk of account overdrafts if repayment is automatic

Safety and Compliance

When using apps like SoLo or similar:

- Use platforms with encryption and data protection

- Always read loan terms and conditions

- Be cautious about connecting bank accounts

- Understand the repayment timeline

Always verify if the app complies with state lending regulations and financial consumer protection laws.

Conclusion

While Solo Lending has carved out a niche as a fast, tip-based lending platform, it’s not your only option. Depending on your needs—whether it’s a small emergency cash advance, a business microloan, or just avoiding payday loans—there are several apps similar to Solo Lending that offer safe, fast, and accessible funds.

If you prefer a peer-to-peer model, consider Kiva. If you want speed and zero interest, Earnin or Dave are solid picks. For larger or longer-term financing, platforms like LendingClub might be more suitable.

Always compare your options, read the fine print, and choose the platform that aligns with your financial goals.

FAQs

1. Is Solo Lending the same as SoLo Funds?

Yes. Solo Lending is commonly referred to as SoLo Funds, a peer-to-peer lending app connecting borrowers with individual lenders.

2. What’s the best alternative to Solo Lending?

Earnin is a top alternative for wage advances, while Kiva offers peer-funded loans without interest for small businesses or entrepreneurs.

3. Do Solo Lending alternatives require a credit check?

Most alternatives like Earnin, Dave, and Brigit do not require a credit check, making them accessible to users with poor or limited credit.

4. Can I borrow money instantly using these apps?

Yes, many apps offer instant or same-day transfers, especially when you link a debit card or pay for expedited processing.

5. Is peer-to-peer lending safe?

Generally, yes—if you use reputable platforms. Look for encryption, verified users, transparent policies, and community reviews.